The best auto insurance company depends on your needs for coverage, budget and digital tools (such as an app and user-friendly website). Bankrate's analysis of the best auto insurance companies in 2022 shows State Farm scores a 3.93/6, the highest overall Bankrate rating. This is based on strong customer service reviews, financial strength, coverage options and competitive premiums. Farm Bureau offers cheap car insurance rates and excellent customer service, making it an attractive option for members. While there is an annual membership fee to join the Farm Bureau, this cost is typically outweighed by the potential savings compared to other insurance companies. These guidelines will determine the company quoted, which may vary by state.

The company quoted may not be the one with the lowest-priced policy available for the applicant. Progressive assumes no responsibility for the content or operation of the insurers' websites. Prices, coverages, privacy policies and compensation rates may vary among the insurers.

In the 1940s, Utah farmers and ranchers recognized the need to financially protect their families and farms. They were seeking insurance coverages that would suit their rural and farm needs and reflect the values of Farm Bureau families. Farm Bureau Financial Services was born and as the company grew it expanded its services to include auto insurance, home and property insurance, life insurance and investments.

Although Utah Farm Bureau Federation and Farm Bureau Financial Services are two separate companies, they partner together to enhance the lives of all Utahns. Like other auto insurance premiums, the cost of coverage depends on a variety of factors, including your chosen level of coverage, or if you add options to your policy. The national average cost for full coverage is $1738 a year, based on data from Quadrant information services. Below are the average rates for annual minimum coverage and full coverage with Farm Bureau. Some of Farm Bureau's local chapters are mutual insurance companies, which means they're owned by policyholders. These don't have to be used as a rebate against car insurance — policyholders can use the funds for anything.

However, dividends are based on the insurer's profitability, so they're not guaranteed. Farm Bureau subsidiaries will monitor their annual performance to determine if they will offer a dividend payment in any given year. Teens pay the most for car insurance, followed by drivers in their early 20s. According to the National Highway Traffic Safety Administration, drivers between the ages of 15 and 20 accounted for 5.3% of all drivers but 7.8% of fatal crashes in 2019. Seniors also find higher car insurance rates on average because of an increase in insurance claims for the age group. Different factors influence how much you pay for car insurance, which is why auto insurance companies personalize quotes for every driver.

Having an at-fault accident can add around $912 to your annual rate, while having poor credit or a DUI can add about $1,400. Southern Farm Bureau Life Insurance Company is a regional provider that serves an exclusive market with limited availability in just 11 states. Membership is required, and you must work with an agent to purchase a life insurance policy from the company. However, it can be a good choice for life insurance when you want plenty of options for your whole and term life insurance.

Because consumers rely on us to provide objective and accurate information, we created a comprehensive rating system to formulate our rankings of the best car insurance companies. We collected data on dozens of auto insurance providers to grade the companies on a wide range of ranking factors. The end result was an overall rating for each provider, with the insurers that scored the most points topping the list.

With the same great policy service and claims service you've come to know from Farm Bureau in your state, you can trust FBAlliance Insurance as you would Farm Bureau. Currently FBAlliance Insurance offers products in the states of Virginia, South Carolina, Montana, Wyoming and Georgia. Southern Farm Bureau's longest term life insurance policy offers guaranteed premiums for 30 years. It still carries the same death benefit as the other term life insurance plans, with a level death benefit of $100,000 or greater. Both insurance companies offer some of the most competitive rates among major carriers.

And while Farm Bureau doesn't have many unique car insurance discounts, its low rates, excellent customer service and additional membership perks make it an attractive option to consider. Your location can affect what you pay for car insurance in a few ways. Some states require more car insurance coverage than others, which can increase the overall cost. Dense metro areas also have higher rates of accidents, which increases rates.

The rates of theft and vandalism in your area also affect car insurance prices, as do natural disasters that cause widespread insurance claims. Farm Bureau Insurance is known for its superior car and home insurance products. It also offers protection for your business, farm and recreational vehicles.

There are 16 regional claims centers in Tennessee and over 350 claims professionals to help when you need it most. Fantastic coverage coupled with exceptional customer service makes Farm Bureau Insurance a popular choice for your insurance needs. Across three driver profiles we studied, Farm Bureau offered competitive, and sometimes the cheapest, car insurance rates. Based on our sample driver profiles, Geico is the only insurer that offers rates on par with the quotes offered by Farm Bureau.

Notably, Farm Bureau was also the only insurer that did not change its annual rate based on gender or marital status. Married drivers tend to pay a bit less than single drivers for car insurance — they save about $100 to $200 per year. Insurance companies have found married people file fewer claims on average and often insure multiple vehicles or household members on one policy.

Car insurance prices are all about risk, and married drivers generally present less risk than single drivers. Good drivers pay $1,732 per year on average for full car insurance, or about $144 per month. This number varies widely depending on company, location and driving record. With leading national providers, annual costs for good drivers range from $1,013 to $2,430 per year. After a car accident, you may not know what to do or who to call.

You might have a personal injury or property damage, and are wondering who is liable. As a policyholder with Farm Bureau Insurance in Kansas or Missouri, you have access to the company claims center for help 24 hours a day, seven days a week. Knowing how to file a claim with Farm Bureau Insurance after a crash is an important part of being a responsible insured driver. The best homeowners insurance is based on a number of factors, including your location and property type. Bankrate's analysis of best home insurance companies found Amica ranked highest based on coverage options, customer satisfaction and financial ratings.

For example, the Bureau's home insurance policy average quote typically ranked among the cheapest major Texas insurance companies for homes with $75,000 in dwelling coverage. However, as with car insurance, shoppers should be aware that Farm Bureau insurance requires an annual membership fee. You may know that by dealing with Texas Farm Bureau Insurance Claims they offer some of the lowest rates when it comes to auto insurance because sometimes it can show in how they process claims. Texas Farm Bureau Insurance is a medium-sized insurance company headquartered in Waco, Texas. Texas Farm Bureau Insurance is only available to the Lone Star State residents.

Here is a brief look at everything you need to know about this insurance company, including its history, market cap, and claims number. We carefully consider several different factors, such as the type of coverage available, availability, resources, qualifications, and eligibility. We also consider company ratings, looking to leading industry leaders like AM Best for financial strength scores. When comparing how Southern Farm Bureau Life Insurance Company performs on an industry-wide scale, we look to one of the best life insurance companies today, New York Life. There are many pronounced differences between the two, the biggest of which being sheer size.

New York Life is the third-largest insurance carrier in the country with nearly 6% market share, while Southern Farm Bureau lags far behind at just 0.05% as a regional provider. For those seeking permanent protection, Southern Farm Bureau Life Insurance Company offers four whole life insurance plans. These policies feature level premiums with long-term coverage and access to cash value that accumulates over time. Whether you're a college student looking for the cheapest quotes or a farmer who's already a member of the local chapter, Farm Bureau's rates are best-in-class.

In this review, we describe Farm Bureau's car insurance coverage options and discounts, and compare its rates to other industry-leading competitors. Like many other car insurance companies, Texas Farm Bureau will do what it can to protect its own financial assets and financial position in the market, even as a nonprofit. Their goal, no matter what, is to pay you as little as possible. If you're unsure about the claims process or worried about your claim, Sutliff & Stout can help you stay protected. You can buy The General insurance in 46 states and Washington, D.C. How much you'll pay for car insurance slightly depends on the state you live in.

We provide policies for drivers in both fault and no-fault states. In fault states, or tort states, those injured in an accident caused by a driver can sue for damages from the at-fault party. In a no-fault state, each driver's insurance company pays for their medical bills and lost wages after an accident, unless the injuries are significant. To set rates, insurance companies predict your risk of filing a claim based on factors in your driver profile. Car insurance companies each have their own way of calculating rates, but they all take similar factors into account. These can include your age, location, gender, marital status, driving record, credit history and vehicle.

Look for a life insurance company that has a great reputation for customer satisfaction, strong financial ratings and a well-established position in the marketplace. An analysis completed by Bankrate shows MetLife ranks the highest in overall financial ratings, customer satisfaction and life insurance options. Most BBB complaints filed against Farm Bureau Insurance by auto and homeowners policyholders involve issues with billing and customer service.

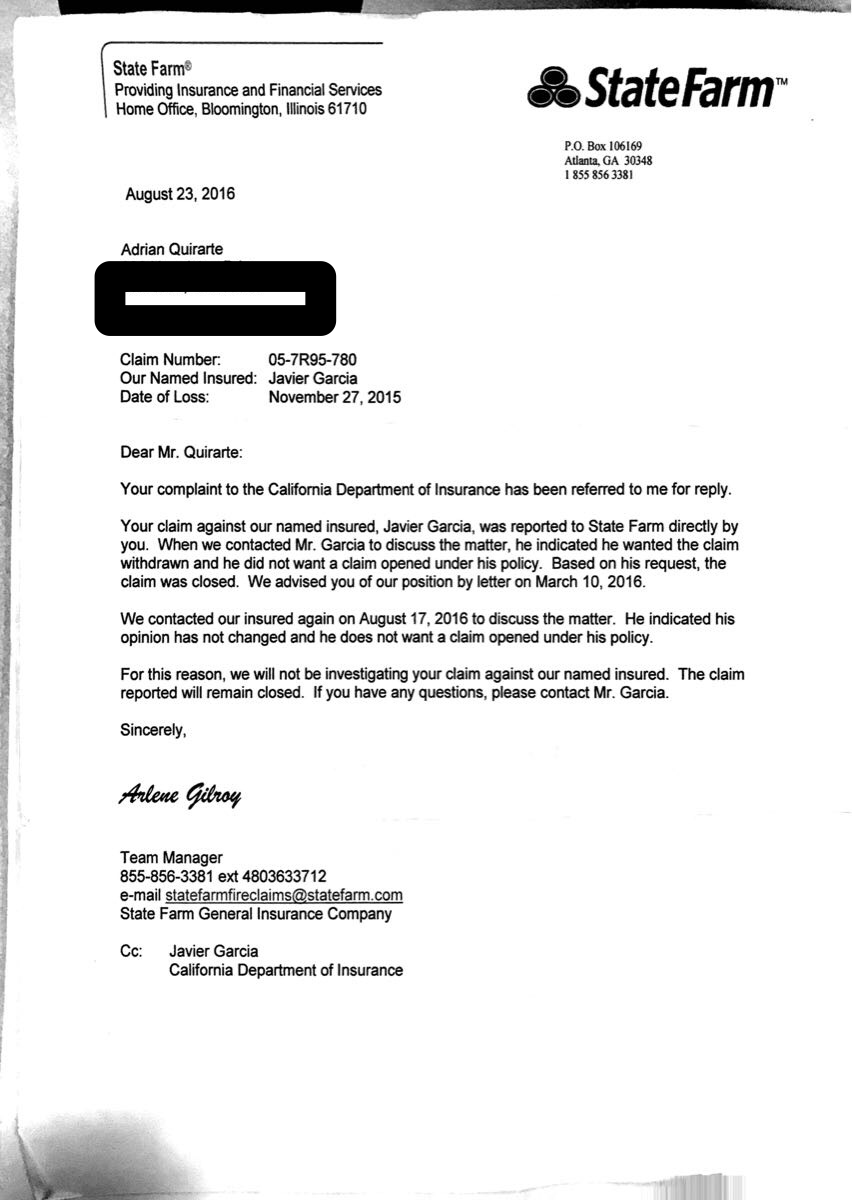

Consumer Affairs also shows cause for concern, with an overall satisfaction rating of just two out of five stars from consumers. Many complaints refer to the difficult quote process and the subpar customer service during claims filing. Additionally, many customers report issues with billing concerns like early policy cancellations and overcharges. In case you've had property damage, and your insurance carrier is not adequately paying your claim, you need to recognize that they may be now not to your side.

They use demonstrated strategies to get you to accept a tiny fraction of what you want to recover financially out of your insurance policy. Our clients can relax knowing we're dealing with each detail of their claim and are aggressively pursuing the compensation they deserve. Although some instances involving are obviously covered by insurance, there are various factors why the insurance company might try to get out of paying you. It is essential to realize that the insurance provider could try to convince you that the cost of fixing your damage is less than the deductible. Don't let the insurance provider take a free ride in rejecting your legitimate claim. Southern Farm Bureau Life Insurance Company is a regional, membership-based provider that offers term and whole life insurance in addition to fixed annuity products and business insurance.

If you qualify, it can be a great choice for those seeking flexibility from the vast selection of riders, as well as no-exam insurance for future policies. Farm Bureau offers some of the most competitive quotes in the car insurance industry. Cheap rates, alongside solid customer service reviews, make Farm Bureau a worthy option to consider for any customer. For simple property damage claims resulting from minor accidents, we recommend you follow the claims process provided by Texas Farm Bureau. If you're unhappy with your settlement offer or suffered a personal injury during the accident, you should strongly consider contacting an expert attorney to help you with your claim.

Call the Houston car accident lawyers at Sutliff & Stout Law Firm for your claim today. If you or your passengers were injured in the accident, we suggest that you call an attorney to evaluate your options. Personal injury claims are not as cut-and-dry as property damage claims and this where insurance companies will use all of their available resources to avoid paying out if it's possible. To make sure you're compensated fairly and all the facts of your accident are brought to light, you should contact the best car accident lawyer you know to help you investigate your case. The Fair Isaac Corporation created a credit-based insurance scoring model in the 1990s. According to FICO, about 95% of car insurance companies use credit-based insurance scores to calculate rates in states where this is allowed.

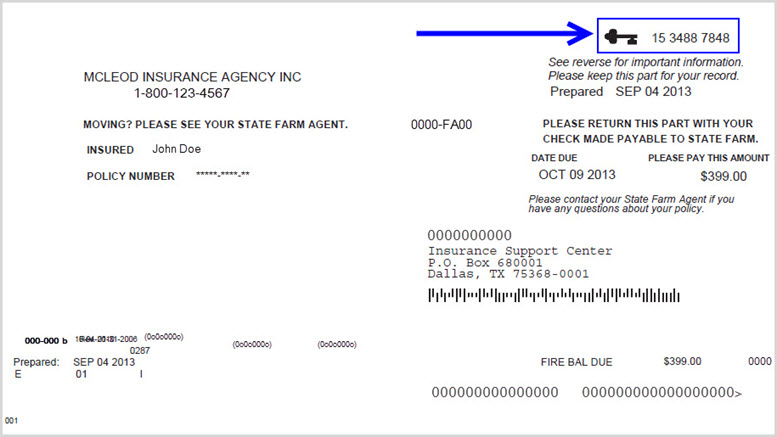

The Federal Trade Commission found credit-based insurance scores to accurately predict risk in a 2007 nationwide study. Among regional providers, Erie tends to offer the cheapest car insurance overall, with rates of $1,113 per year for full coverage insurance. Auto-Owners Insurance, Southern Farm Bureau and New Jersey Manufacturers Insurance are all cheaper than the national average, as well. Any of these three options will achieve the same end and put you in contact with a Farm Bureau Insurance claims adjuster. If you choose to file your claim online, follow the directions and fill out the form in as much detail as possible.

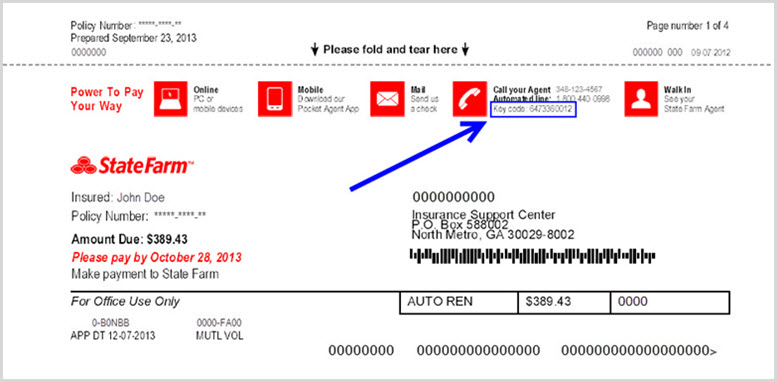

Farm Bureau Insurance Provider Phone Number An insurance adjuster will contact you following your online submission for more details about your accident. If you speak with an adjuster via phone, he or she will explain the process directly. Visit the company online to learn more and locate an agent near you. All insurance products are governed by the terms, conditions, limitations and exclusions set forth in the applicable insurance policy.

Please see a copy of your policy for the full terms, conditions and exclusions. Policy obligations are the sole responsibility of the issuing insurance carrier. Our insurance team is composed of agents, data analysts, and customers like you.

They focus on the points consumers care about most — price, customer service, policy features and savings opportunities — so you can feel confident about which provider is right for you. When you retain our services, we fight to protect your rights as a policyholder. According to our research, Texas Farm Bureau auto insurance rates are very competitive, with the lowest rates in the state.

However, it should be remembered that to purchase an insurance policy from the association, you must first pay an annual membership fee. Texas Farm Bureau auto insurance plans are fairly standard, with a small range of optional options that most other insurers can have, such as roadside assistance. Texas Farm Bureau does provide competitive rates for drivers, especially those with prior incidents on their records, making it a viable choice for those concerned about their driving records. This plan offers guaranteed level premiums for 10 years that increase after that.

Plans carry a level death benefit of $100,000 or more, and you can renew your plan through the age of 95. There are five plans for Southern Farm Bureau term life insurance. These policies offer temporary, short-term coverage that carries either guaranteed or graduated level premiums.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.